WeWork—or The We Company, if we must—published its hotly anticipated IPO filing today, ahead of a planned listing next month that will raise $3.5 billion or more.

Included in the 350-page report are new details about the office-space rental company’s financial situation. The headline number is that WeWork lost $4.2 billion between 2016 and the first half of 2019. Other startups have lost far more money—Uber burned through $5.2 billion in the second quarter alone—but WeWork’s losses are noteworthy considering that the company generated only $4.7 billion in revenue over that time. It’s no wonder that WeWork is looking to raise up to $ 4 billion in debt alongside the IPO, on top of some $8 billion in venture capital raised to date, according to research firm PitchBook.

“Our strong unit economics, together with the increasing cost efficiency with which we open new locations, gives us the conviction to continue to invest in finding, building, and filling locations in order to drive long-term value creation,” the company said in its IPO filing.

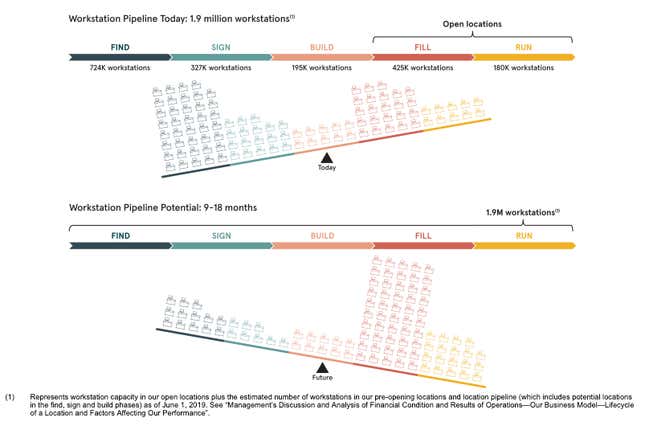

WeWork’s plan for monetizing its memberships—comprising some 1.9 million workstations currently available or in the works—is somewhat impressionistic. Here’s how it works:

Other diagrams in the document suggest that locations can break even within six months of opening, although “mature” locations that have been open for two years or more are able to generate “a recurring stream of revenues, contribution margin, and cash flow.” This is the “run” phase of operation in the diagram above, which accounts for 30% of the company’s available workstations at the moment (and 10% of the total workstations either available or soon to come online).

Where is WeWork’s money going?

WeWork says that it is becoming more efficient at adding new workstations, with capital expenditure per seat falling by half, to around $3,600, from 2014 to mid-2019. Its overall pre-opening location expenses fell to around 17% of revenue in the first half of this year, versus 27% three years ago. This is only one category of expenses, however, and far from the biggest one. The routine costs of running an office after it has opened comprised 80% of revenue in the first half of 2019, down from 99% in 2016.

Added together with sales, marketing, development, and other costs, WeWork’s expenses accounted for 190% of revenue in the first half of this year, almost exactly the same as in 2016. Its ability to extinguish the cash burn will rely on getting locations into their “mature” phase as quickly as possible, and before a potential economic downturn upends its business model in more fundamental ways.